Non-runners

Why has horse racing gone on strike?

There will be no horse racing in Britain today. The industry has gone on strike in protest at government plans to increase taxation.

Until 2019, online betting and online casino companies paid the same tax of 15% on Gross Gambling Yield (GGY), which amounts to stakes minus prizes and can be considered revenue (not profit). Then the government effectively banned fixed-odds betting terminals (FOBTs) and created a black hole of around £1.5 billion that needed filling. Online casinos took the hit and their tax rate went up to 21%.

The government is now seriously considering ‘harmonising’ these tax rates which, in practice, will mean making them both at least 21%. This, remember, is on revenue and comes on top of corporation tax paid on profits (25%) and, for bookmakers, the Horserace Betting Levy (10%) which goes towards “the improvement of horseracing and breeds of horses and for the advancement of veterinary science and education”. The latter is an essential source of funding for racing industry. There is also now a gambling levy of up to 1.1% of GGY.

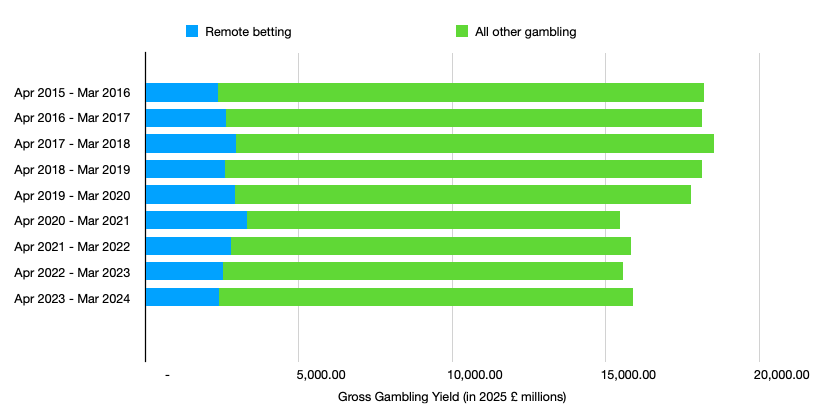

The impression given by the media is that gambling is a booming industry in the UK, but this is questionable. In real terms, total gambling expenditure (GGY) is significantly lower than it was before the pandemic.

The number of betting shops has declined by 35% since 2015 and, despite claims to the contrary by the Labour MP Dawn Butler, the number of Adult Gaming Centres has declined by 10% over the same period.

In the supposedly booming online sector, betting revenue (including on racing and other sports) is down 17% in real terms since before the pandemic (2019/20) and even the online gaming (casino/slots) sector, which the government claims is growing “exponentially”, has only grown by 10% over the same period.

Economists are interested in tax incidence, i.e. who ultimately bears the economic burden of a tax. The answer is usually the consumer and so it is here, but in an unusual way. The operator can’t simply increase prices because punters choose what to stake. Instead, faced with an extra cost of doing business, a bookmaker will need to protect his margin. The main way he can do this is by giving longer odds, but he could also reduce the number of places in an each-way bet or withdraw free bet offers and other inducements. All of this makes his business less appealing to bettors and more susceptible to competitors who can offer better odds. In practice, this means unregulated gambling websites, of which there are many (the Gambling Commission took 264 of them down last year and referred tens of thousands of sites to Google).

If the government squeezes him too hard, the bookmaker may decide to exit the industry altogether or move to a country where he feels more welcome. People in all walks have life have been having such thoughts since Rachel Reeves became Chancellor.

Where does horse racing come in? As mentioned, it is highly dependent on the horse racing levy paid by bookmakers. If bookmakers make less money or move offshore, the racing industry gets less money. And bookmakers are already making less money thanks to affordability checks being enforced by the arbitrary and capricious Gambling Commission (total betting GGY has declined by 30% in real terms since 2019/20 - a shortfall of more than £2 billion).

The British Horseracing Authority (BHA) believes that hiking betting duty to 21% will cost the industry hundreds of millions of pounds and result in thousands of job losses. Such predictions are always uncertain but there can be no doubt that racing will be seriously harmed.

The subplot to all this is that the anti-gambling lobby have been working with the racing lobby to throw the rest of the gambling industry under the bus. The anti-gambling lobby in Britain is effectively Derek Webb and the various lobbyists and think tanks he funds or has funded, particularly Matt Zarb-Cousin (Clean Up Gambling), Will Prochaska (Coalition to End Gambling Ads) and the Social Market Foundation (SMF).

The SMF have called for remote gaming duty to rise to 50% (!) while Matt “not anti-gambling, just anti-FOBTs” Zarb-Cousin has called for online casinos to be taxed “into oblivion”. The SMF’s ‘concession’ to sports bookies is a 25% tax consisting 5% duty and 20% Horserace Betting Levy which amounts to the same as they pay now (15% duty plus 10% racing levy). This is because they know that horse racing is popular with the public and it gives them a way to “peel off and neutralise racing” - to quote Zarb-Cousin - while they hammer the rest of the remote gaming sector.

This is unlikely to end well for racing, as the chair of the Horseracing Bettors Forum, Sean Trivass, says:

“If bookmakers get massively hit with new taxes on slots and casinos, they will tweak racing bonuses, overrounds and extra places, and shut a few more accounts.”

That means less money for racing. Moreover…

“Will they come after racing once they’ve dealt with slots and casinos?” asks Trivass. “If we had another meeting with these guys, I would want to ask them, ‘Is this the end of it? Are you prepared to give a guarantee in writing that you're not going to come back to get us in the future?’”

It’s a big gamble for racing so let’s consider the odds. Derek Webb started out being ostensibly concerned about FOBTs and about FOBTs only. When his campaign against those machines succeeded, he closed down Stop the FOBTs and set up Clean Up Gambling with a much broader remit and also created the Coalition to End Gambling Ads (all gambling ads). The APPG on FOBTs, which Webb part-funded, became the Gambling Reform APPG and is now solely funded by Webb. There is a growing belief among the anti-gambling lobby - endorsed by Webb - that the ‘total consumption model’ applies to gambling, i.e. the more gambling there is, the more harm there is, and that the optimal level of gambling in society is therefore zero. Zarb-Cousin has already said that he wants dog racing banned.

These are clearly not people who can be trusted to pack up their tent when they have achieved their short term objective. It seems to me that a united front from the whole industry would be a better approach when dealing with fanatics, but if the racing industry insists on supping with such people, it should bring a very long spoon.

Most bookmakers seem to be based offshore. Ideally the tax should be structured to hit these guys harder. Now we are out of the eu we have freedom to impose laws like this. I agree that hitting horse racing is not a good idea as it is not prospering. Don’t have too much sympathy for bookmakers though they still make a lot of money, and you don’t mention the social and economic costs of gambling addiction, which are considerable. Bookmakers have totally failed in self regulation to exclude problem gamblers. Surprise surprise. The government is right to increase tax on betting but target it at offshore companies.