Further to my scribblings elsewhere about the sugar tax, I haven’t yet mentioned the proposed lowering of the sugar threshold at which the tax is paid. This seems to be the most irksome element from the perspective of soft drink companies that have already spent a lot of money debasing their products to meet the 5g limit.

A spokesman for the British Soft Drinks Association, an industry body, said the decision was a “muddled and damaging shifting of the goalposts” that risked undermining years of reformulation investment with questionable positive health outcomes.

He added that lowering the threshold “comes at a time of major and unprecedented financial headwinds for our members, from record-high inflation and national insurance increases, to spiralling ingredient costs and incoming trade tariffs. Such cost increases have already impacted our members’ ability to grow their businesses and boost employment, and the lowering of the threshold risks making this even more challenging.”

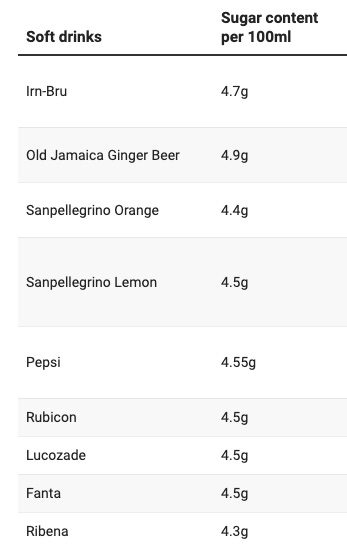

The Times has provided a handy list of the main brands that have been reformulated since the sugar tax was announced and how much sugar is in them (per 100ml).

As you can see, all of them have a sugar content just below the 5g threshold. This is because, contrary to what some of the companies have claimed, they were not responding to consumer demand but were trying to avoid the tax. They invested in a lot of R & D to make low sugar drinks taste as good as they can (and largely failed, imo) because they assumed it would be a one-off.

Not knowing their enemy, they did not count on two traits of ‘public health’ zealots. Firstly, they can never be appeased. Secondly, they conflate compliance with the law with ‘loopholes’. They want no sugar in soft drinks at all and were never going to be happy with 4.5g per 100ml.

I could add a third trait which is their mad belief that imperceptible changes at the individual level magically transform into large effects at the population level. Some of these people genuinely believe that the health of the nation will be measurably improved if Ribena has 3.9g of sugar instead of 4.3g. That is certainly the implication of the laughable Impact Assessment.

Assuming the government drops the limit to 4g, as proposed, these companies have a choice. They can spend a fortune reformulating and relaunching their products again - making them taste even worse - or they can keep the drinks as they are and start charging more for them. Or they can wake up to the fact they are being taken for a ride by fanatics who want to destroy them and bring back the unadulterated originals. People can always buy the diet versions if they want.

It’s time for these companies to grow a backbone. Appeasement has not worked and never will. If they capitulate a second time, you can be sure that they will have to do it for a third time in a few years. So rise up, Ribena! Gird your loins, Irn-Bru! Make them like you used to.

They should increase the price to cover the tax and put a prominent label on each product to disclose the amount of sugar tax being paid. Make it abundantly clear to consumers who is to blame for the price increase.

For the same reason utilities should make the “green” levies embedded in bills as explicit as VAT is.

Anecdata: I used to pop antacid tablets like they were sweets. I can't remember how I discovered this but I now drink a litre of zero sugar Pepsi Max a day and no reflux. The Pepsi replaces all but one of the three or four mugs of strong sweet coffee I was drinking.