Black holes and Austerity 2.0

The left is tying itself in knots in its haste to bury Trussonomics

George Osborne must be kicking himself for not calling the budget deficit a ‘black hole’ when he launched ‘austerity’ in 2010. Judging by recent media coverage, it would have helped him get the left-leaning media on board.

Osborne was actually far more ambitious than Jeremy Hunt. He wanted to balance the books whereas Hunt merely wants debt to stop rising as a percentage of GDP by 2025. The fabled ‘black hole’ is the amount of borrowing he needs to cut to achieve this. Estimates of its size vary and it depends on various factors - especially economic growth - but figures between £30-£60 billion a year are bandied about.

The deficit, meanwhile, is much bigger than this. The UK is expected to borrow the thick end of £200 billion this year. The national debt is at £2.5 trillion. In Britain, as in much of the western world, inflation is in double digits and interest rates have been rising as a result. The EU and the UK are very likely in a recession already.

Fairly obviously, these problems have been caused by two years of unprecedented quantitative easing, Covid-related supply chain problems and an energy crisis. And yet a significant number of people seem to genuinely believe it is because Liz Truss ‘crashed the economy’.

The Observer was at it again yesterday, claiming that the mini-budget ‘cost the country a staggering £30 billion’ and doubled the ‘fiscal hole’.

The implication is that there wouldn’t be any need for higher taxes or spending cuts if Truss hadn’t been in power for a month and a half.

The Observer quotes ‘the independent [i.e. left-wing] Resolution Foundation’ as the source of its figures. The RF put out a briefing on 1 November in which it estimated that the fiscal hole was £30 billion.

According to the Observer, this is Truss’s fault because…

The RF’s economists estimate that in her seven-week premiership £20bn was blown by Truss and her chancellor Kwasi Kwarteng on unfunded cuts to national insurance and stamp duty, with a further £10bn added by higher interest rates and government borrowing costs as the markets reacted with dismay to the former prime minister’s dash for growth.

But £10 billion has not been added to government borrowing costs as a result of the mini-budget. As the RF document explains, interest rates are rising around the world and ‘global rates rises since September are likely to cost over £10bn per year by 2026-27’.

However, the executive summary contains the following sentence which is written in such a way that it could mislead anybody who wants to be misled.

Interest rates are rising around the world (increase since mini-budget costs HMT around £10bn)

This seems to be where the Observer got confused.

This is not to say that there was no cost to the mini-budget. Because it was seen as inflationary, gilt yields rose for a while and the pound fell, but both have since gone back to roughly where they were before 23 September. There has been virtually no impact on the government’s borrowing costs in the longterm. Inflation itself is the bigger problem because around a quarter of the UK’s debt is index-linked.

30 year gilt yields shown below, with the USA and France as a comparison:

What about the claim that ‘£20bn was blown by Truss and her chancellor Kwasi Kwarteng on unfunded cuts to national insurance and stamp duty’? ‘Blown’ is an interesting choice of word, as if this money disappeared into thin air. In fact, it represents a transfer from the state to taxpayers - and these two things are supposed to be roughly the same thing.

Firstly, it wasn’t £20 billion. The RF estimates that it amounts to £17 billion by 2025/26. Perhaps the Observer rounded this up to £20 billion so they could get a total figure of £30 billion which matched the estimate of the fiscal hole in RF’s presentation?

This £17 billion is overwhelmingly made up of the ‘cost’ (to HMRC) of cancelling the 1.25% rise in National Insurance. The government’s estimate in September was that this would cost £16,995 million in 2023/24 whereas raising the stamp duty thresholds would only cost £1,450 million. (The only other part of the mini-budget mentioned by RF - making the Annual Investment Allowance permanent - was estimated to cost a relatively trivial £930 million.)

So by far the biggest contributor to the ‘fiscal hole’ from the ‘disastrous mini-budget’ was not even a tax cut, but a failure to increase National Insurance. Does the Observer therefore believe that National Insurance should be increased? It seems unlikely given that the rise was widely criticised for being regressive and the Labour Party voted against it in April, tried to get in cancelled in May and voted against it again - this time with the government - last month.

The obvious point to make about the mini-budget is that most of it never happened and the few bits that survived have cross-party support. The Observer doesn’t even mention the Energy Price Guarantee which is estimated to cost £60 billion this financial year and was easily the most expensive part of the mini-budget. Without it, there would be no ‘fiscal hole’ at all, and yet the Observer does not talk about Truss ‘blowing’ £60 billion on the Energy Price Guarantee, presumably because it is rather popular and the Labour Party wanted to spend even more on it.

The irony is that the Observer is so blinded by its contempt for Truss and her vision of a smaller state that it ends up carrying water for Sunak and the new era of ‘austerity’.

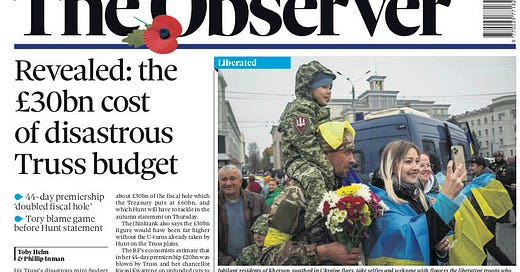

Liz Truss’s disastrous mini-budget cost the country a staggering £30bn – doubling the sum that the Treasury says will have to be raised by Jeremy Hunt this week in a huge programme of tax rises and spending cuts.

… The estimates of the cost of “Trussonomics” will intensify a bitter blame game now being played out at the top of the Tory party.

While many Conservative MPs will be angered by more tax rises, the chancellor is expected to make clear that he is, in large part, having to repair damage caused by the last occupant of No 10, who was backed by many rightwing Tory MPs.

Both Sunak and the left have an incentive to perpetuate the ‘Truss crashed the economy’ trope. They should both be more careful. The Conservatives should realise that the conventional narrative will soon be ‘the Tories crashed the economy and made us pay for it with Austerity 2.0’. From the left’s perspective, it takes for granted a version of fiscal conservatism with which many of them disagree.

As I said when Truss was still in power…

If I thought the government was capable of playing 4D chess, I would say that the whole thing was a cunning plan to make fiscal conservatism popular again.

It wasn’t deliberate, of course, but the implosion of the Truss administration was bitter-sweet for anybody with a brain on the left. A Tory Prime Minister went down in flames, which they enjoyed, but only by starkly illustrating that the government cannot borrow huge sums of money indefinitely without some kind of plan to balance the books.

Left-leaning economists who can see more than one move ahead understand this. Last week, the Progressive Economy Forum - a group of Keynesians, Marxists and MMT advocates - challenged the very existence of the black hole. An article in yesterday’s Observer did likewise. Although the Observer front page went down well with the kind of moron who thinks the government spent £37 billion on an app, the better educated spotted a trap.

In its haste to bury Trussonomics, the Observer not only endorses the idea of a ‘black hole’, but endorses Jeremy Hunt’s rather arbitrary definition of what a ‘black hole’ is. When Hunt announces £30 billion of tax rises and spending cuts on Thursday, it will be difficult for the newspaper to argue against it, although given the short memories, doublethink and confirmation bias of its readers, I’m sure it will find a way.

I'm not sure I agree with the conclusion. One can agree with the existence of a black hole while disagreeing with government's plan to close it. It's not inconsistent to think that government borrowing is too high but that it can be reduced by soaking the rich, for example.

Unbelievably depressing how the media continues to beef up the argument that suits their narrative.

Is there any newspaper actually giving an objective view?